A brief history of Quakers and banking

From founding Barclays to backing credit unions – Olivia Hanks takes a look at Quaker work on banking.

Alongside famous manufacturing businesses with Quaker origins like Cadbury, Rowntree's and Clarks, there are two other household names whose early success was built by Quakers: Lloyds and Barclays.

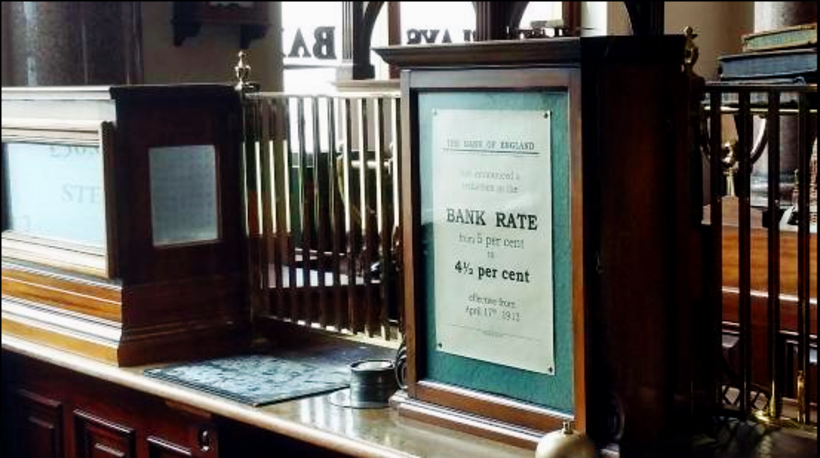

These big names in banking might not occur to you when you think of Quaker values of peace, equality and sustainability, but both were established by Quaker families. Though they no longer have a Quaker connection, Lloyds was formed in 1765, while Barclays began back in 1690.

Shifting ethics

By the last decades of the 19th century, many private family firms had become joint-stock companies owned by a large number of shareholders. A series of new laws around mid-century had made share ownership much more attractive by establishing the concept of corporations and awarding them limited liability, so that shareholders were liable for a company's debts only up to the value of their investment. Until then, a company's owners had been liable for all its debts, meaning a failure could bankrupt them. Limited liability was extended to banks in 1862.

This liberalisation of the market made enormous sums of capital available to businesses, enabling vast expansion. It also distanced them from their founding principles, as corporations began to be run for the benefit of their shareholders.

Since companies trading on the stock market are owned by huge numbers of ever-changing anonymous shareholders, typically this 'benefit' has been deemed to refer only to profit and not to any wider concerns of value or purpose – a problem that continues today.

This lack of accountability to the wider public has become a striking feature of the global banking system, made more serious by the fact that banks now create 97% of all money. Their control over the monetary system means they know they cannot be allowed to fail – resulting in a state of affairs where they can make reckless decisions with few consequences for those in charge.

A lack of accountability to their customers has resulted in banks closing branches and removing services, while a lack of regulation and a systemic failure to see beyond short-term profit means most continue to invest in arms companies and dirty fossil fuels.

Banks also continue to lend disproportionately to property and financial markets rather than productive businesses – one of the principal causes of the 2008 financial crisis.

Envisioning alternatives

Lots of Quakers around Britain began grappling with these issues as part of our new economy reading series, and are now asking: what can we do? The Religious Society of Friends' banking heritage has led many Quakers to feel a particular interest in this issue, with some wondering whether a Quaker bank could be part of the solution.

The Quaker Bank Group was set up within the Quakers & Business Group to explore what a Quaker bank would look like and whether the idea is feasible. John Lovatt, convenor of the group, says: "Like many others, we were dissatisfied with the self-centred behaviour of high street banks. We believe that the Quaker commercial tradition needs reviving, founded on Friends' Testimonies and the Quaker Business Method."

So what would it mean in practice to run a bank according to Quaker testimonies?

"For a start," says John, "the bank would be owned by lenders and borrowers, not outside shareholders, and on a not-for-profit basis. Our unique view is that the bank, acting as a facilitator, should not make more money than the saver.

"A Quaker bank would never force a borrower into bankruptcy, and would show all lending contracts on its website in the interests of transparency."

The reality of setting up a bank has proved immensely challenging, in part because of the amount of capital required. The group has also looked at the possibility of establishing a credit union, but these require members to have a common bond, usually geographical or based on working for a particular employer.

Setting up a Quaker credit union for members of the Society of Friends is possible – but would an exclusive 'club' of this kind really be 'letting our lives speak'?

Practical support

The Society has changed a lot since the heyday of the Quaker banks. So does a bank run in line with Quaker values actually need to be Quaker in name? Perhaps our role in the movement for banking reform is not to start up a new alternative bank, but to support others who are already doing good work.

This is the conclusion North Wales Quakers Credit Union Group came to. Having initially aimed to set up a Quaker credit union, their research led them to decide that it would be more useful to raise awareness of credit unions in general and encourage Quakers and local meetings to join them. You can read their briefing and advice on credit unions online.

For those interested in ethical, member-owned banks, the regional bank project run by the Community Savings Bank Association (CSBA) offers a glimpse of a fairer future. The CSBA is working to establish a network of regional banks, lending to local people and businesses and reviving the role of face-to-face relationships. Perhaps Quaker support for this initiative will be a contemporary form of Quaker influence on financial services.

For ideas on how to take action for better banking, see our new action guide – the first in a new series looking at practical ways to build the new economy.